Bitcoin’s hash rate has surged to unprecedented levels, indicating a growing divide between network security and actual usage.

Despite the record-setting computational power dedicated by miners, concerns are mounting over the network’s long-term economic viability as transaction fees remain minimal and blocks are often left underutilized.

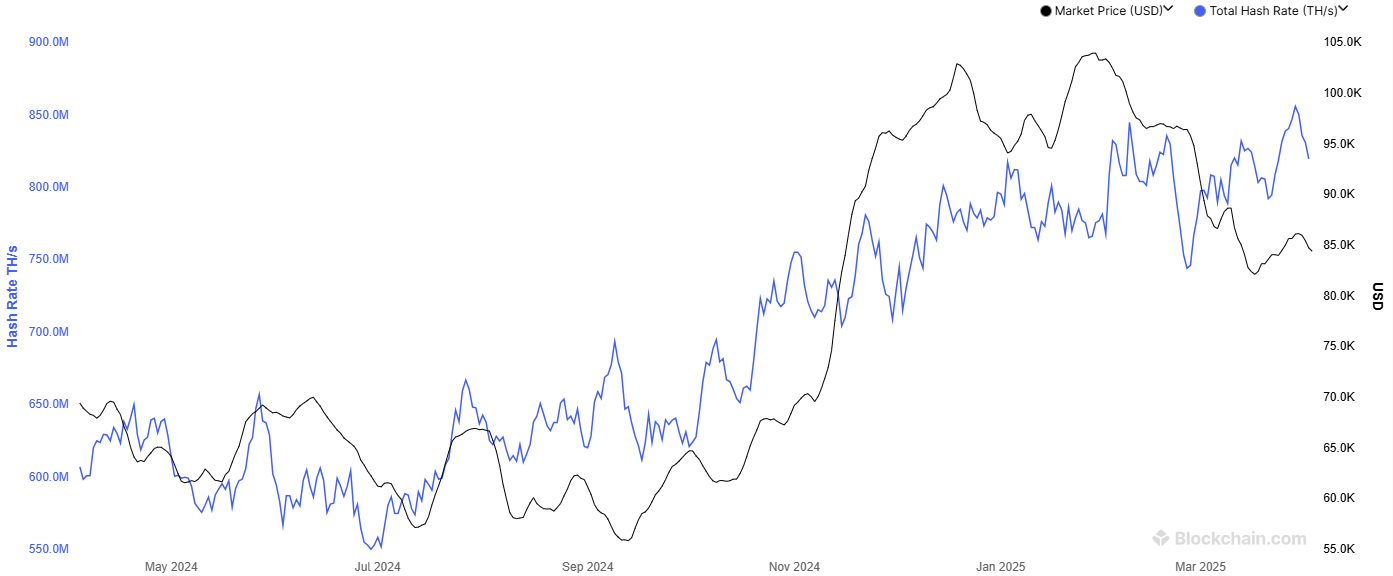

Recently, Bitcoin’s 14-day moving average hash rate hit an all-time peak of 838 exahashes per second (EH/s), while the 24-hour hash rate approached the second-highest mark ever recorded at 974 EH/s, as reported by Glassnode. This increase in mining power is expected to push network difficulty up by more than 3% in the coming days, marking a new record. The adjustment is designed to maintain a consistent block time of around 10 minutes.

However, this surge in mining activity does not align with the broader crypto market landscape. Bitcoin’s market value is still about 25% below its previous peak, while on-chain activity remains notably subdued. Transaction fees have plummeted to just 4 BTC per day, highlighting the growing reliance on block rewards for miner revenue. Currently, miners earn 3.125 BTC per block, but as Bitcoin’s block subsidy halves every four years, the lack of substantial transaction fees could undermine long-term profitability.

The disparity between increased mining power and weak network usage has prompted industry experts to question the future stability of Bitcoin’s mining model. Some argue that the narrative of Bitcoin as a “store of value” may ultimately hinder its broader adoption, as holding BTC takes precedence over spending. As the costs associated with maintaining network security continue to rise, a sustainable future may depend on boosting real-world utility rather than relying solely on digital gold status.