Bitcoin’s recent market activity has sparked debate among analysts, with CryptoQuant CEO Ki Young Ju asserting that the bull run has officially ended.

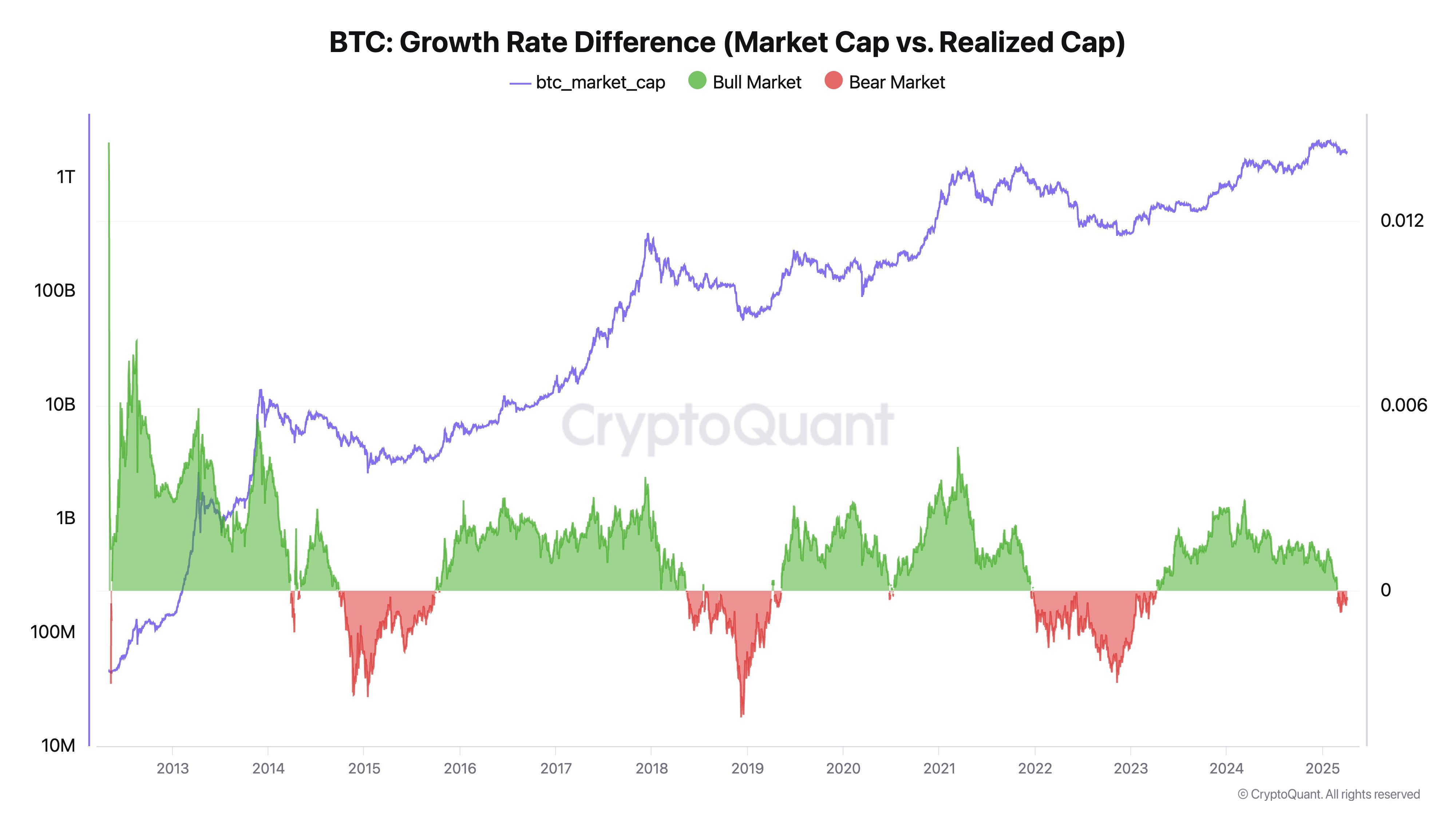

Ju points to specific technical indicators that suggest the bullish momentum is exhausted. His theory centers on the dynamics between Bitcoin’s Realized Cap and Market Cap, which he sees as critical for understanding the current market phase. Unlike traditional market capitalization, which calculates value based on the circulating supply and current price, Realized Cap reflects the cost at which each Bitcoin was last moved between wallets.

Ju argues that focusing solely on Market Cap can be misleading, as it often rises even with minimal buying activity when selling pressure is low. This phenomenon can create a false sense of bullishness, which, according to Ju, has been the case recently.

A key example highlighted by Ju involves a major purchase of over 22,000 BTC for nearly $2 billion, which failed to trigger a significant price surge. He sees this as a clear sign that the market is no longer reacting as it once did to large buy orders, primarily because sell pressure has intensified. As Realized Cap continues to rise while Market Cap declines, Ju interprets this divergence as a signal of a sustained bearish trend, even as new money flows into Bitcoin.

This observation challenges the assumption that increased investment necessarily drives prices upward. Ju believes that without a significant reduction in selling pressure, the chances of a substantial rally remain slim. He projects that it may take up to six months for Bitcoin to break out of this bearish cycle.

While some speculate that Bitcoin could briefly dip to $80,000 before finding a stronger footing, Ju remains doubtful about any imminent recovery. Despite this cautious outlook, others, including US Treasury Secretary Scott Bessent, continue to view Bitcoin positively, drawing comparisons between the cryptocurrency and gold as a store of value. However, Ju’s analysis reflects a more guarded perspective, emphasizing that real market reversals historically take time to develop.