Pakistan’s mobile gaming industry is undergoing rapid expansion, fueled by increasing smartphone penetration, affordable internet access, and a growing pool of local developers.

A recent study by Tenjin, a platform that provides advertising measurement tools, reveals that the number of mobile gamers in Pakistan is expected to reach 50.9 million by 2026. This growth is set to generate more than $8 million in revenue, as the country establishes itself as a significant player in the South Asian gaming market.

The study, which surveyed 50 mobile gaming studios in Pakistan, highlights several key trends. The majority of these studios are small, with 40% employing just 1-10 people. Additionally, 32% have teams of 50 or more employees, while 28% operate with 11-50 employees.

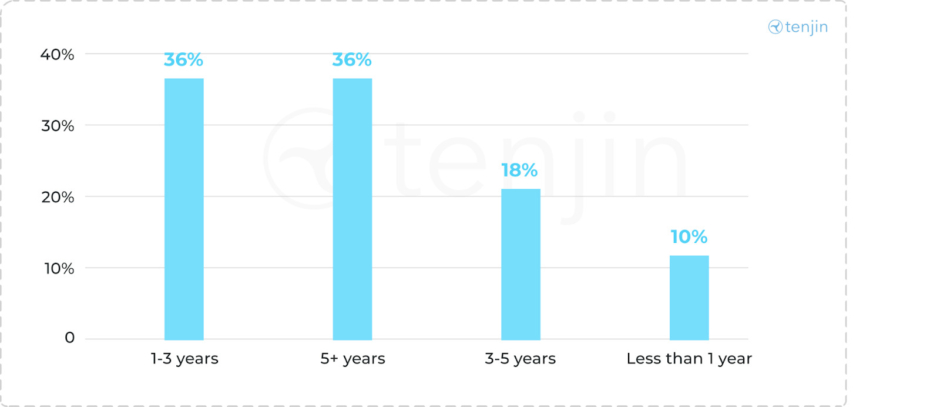

When it comes to the longevity of these studios, 36% have been in operation for 1-3 years, and 36% have been running for 5 years. A smaller percentage, 10%, are newer, having been established for less than a year.

In terms of game genres, simulation games dominate, with 80% of developers focusing on them. Casual and hyper-casual games are also common, with 52% and 48% of studios, respectively, developing these types of games. Other genres such as mid-core games and miscellaneous genres make up smaller portions of the market.

These studios generate their revenue through two primary sources, including in-app advertisements (IAA) and in-app purchases (IAP). The studios segment their earnings between IAA with IAP for 66% of cases, while IAA remains the only revenue source for 30% and the studios use IAP exclusively for 4%.

A survey reveals that studios that receive less than $1,000 account for 40% of the studios and another 40% generate revenue between $1,000 and $10,000 each month. Revenue data shows that studios earning over $50,000 per month account for 8% of the studios, while 12% generate revenue between $10,000 and $50,000. Total studios with earnings falling below $1,000 amount to 40%.

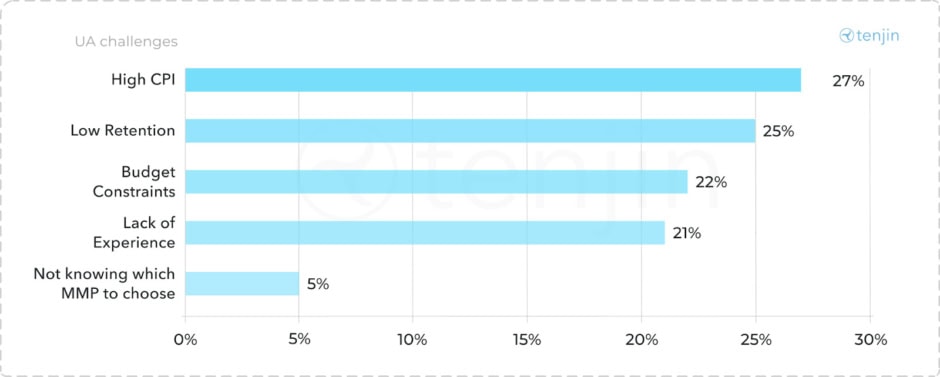

User acquisition stands as the primary operational difficulty that Pakistani mobile gaming studios encounter in their operations. The high price developers must pay for each installation remains the major barrier for 27% of studios, alongside the 25% who struggle most with maintaining user retention. User acquisition strategies face two major obstacles from studios: limited budgets (22%) and insufficient experience (21%) in finding acquisition methods.

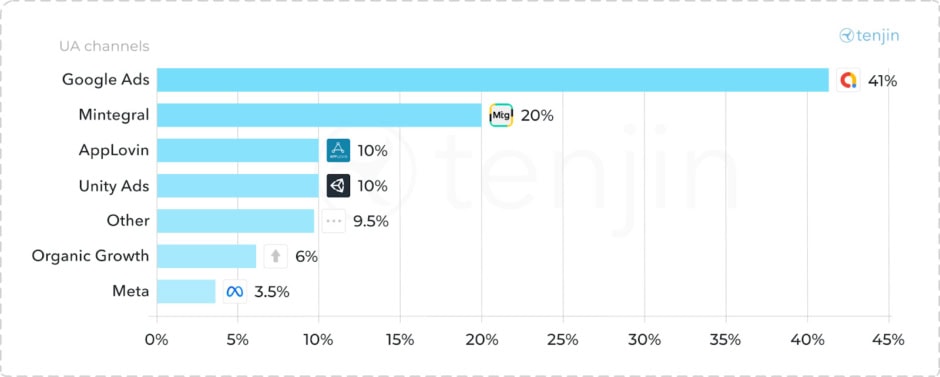

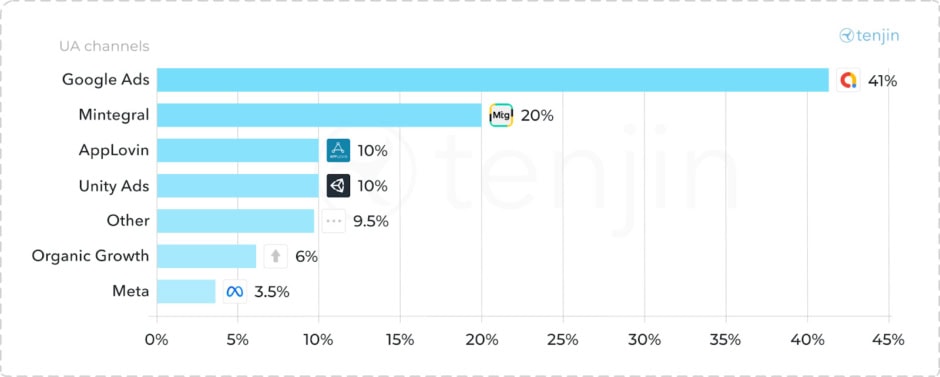

Marketing efforts are primarily focused on return on ad spend (ROAS), with 64% of studios prioritizing this key performance indicator (KPI). Users make Google Ads their preferred user acquisition channel according to 41% of survey respondents, while Mintegral, Applovin, and Unity Ads round out the second position.

The study also analyzed the performance of mobile publishers and games in 2024. The data reveals a strong market presence for local developers, showcasing top performers in both revenue and downloads. These findings underscore the potential of the Pakistani gaming industry, with more developers capitalizing on the growing demand for mobile gaming content.

Looking ahead, industry experts predict that Pakistan’s mobile gaming sector will continue to grow, driven by advancements in technology and a burgeoning global market. However, experts emphasize the need for local developers to enhance user retention strategies and consider adopting mobile measurement platforms to optimize their marketing efforts and improve advertising effectiveness.