- Whale wallets rise to 240,000, a six-month high.

- MACD nears bullish crossover, signalling possible breakout.

- DOGE faces key resistance at $0.21.

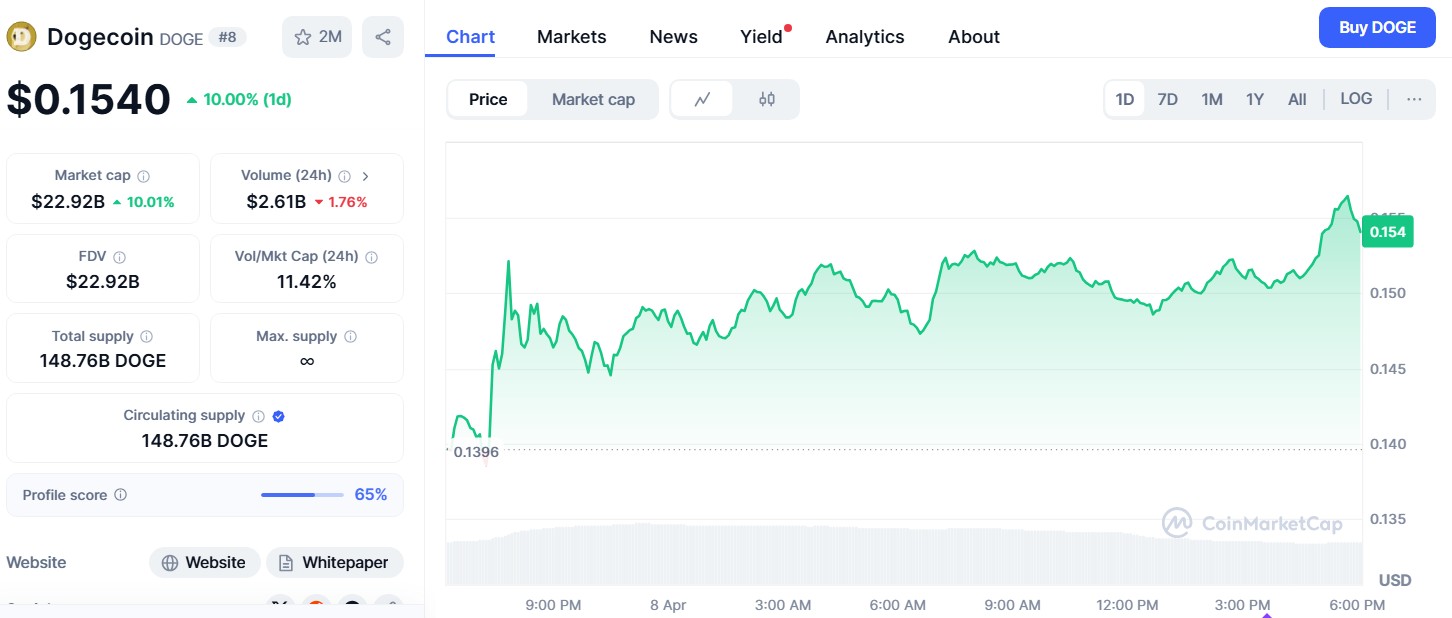

Dogecoin price has climbed 10% in the past 24 hours, now trading at $0.1540, after falling 12% earlier this week following the US government’s latest tariff announcement under President Trump.

Source: CoinMarketCap

Despite the volatility, the memecoin remains above key support levels and is showing signs of renewed strength.

Technical indicators and on-chain data suggest growing buying interest, particularly from whales.

The number of large wallets has hit a six-month high, hinting at a potential breakout.

As trading activity increases, DOGE’s price trajectory in the coming days could be shaped by whether bulls can push it past the $0.21 resistance zone.

DOGE holds key support after 70% rise

The Dogecoin price recently surged to a high of $0.48, gaining over 70% before facing profit-taking pressure.

Following a dip that pushed the price below $0.15, it has now rebounded sharply.

Despite the 12% drop linked to macroeconomic news, DOGE held onto its crucial support range.

This price stability has coincided with increased trading volumes, suggesting strong market participation even amid external shocks.

DOGE’s ability to stay above this level has historically been a key indicator for upcoming upward moves, especially when backed by accumulation.

Whale wallets rise to 240K

On-chain data shows a sharp increase in the number of Dogecoin wallets holding 10,000 or more tokens.

These wallets have risen from 236,000 to 240,000 in recent days, marking a six-month high.

This signals growing confidence among mid-sized and large holders, many of whom appear to be using price dips as buying opportunities.

This accumulation could be a precursor to a major move, especially if the broader market turns bullish again.

MACD nears bullish crossover

From a technical standpoint, Dogecoin remains in a consolidation phase.

It is currently testing the 0.236 Fibonacci retracement level after failing to break above the 0.382 level at around $0.21.

The MACD indicator on the weekly chart shows a decline in selling pressure, and the gap between signal lines is narrowing.

This movement points towards a possible bullish crossover. If confirmed, it may trigger momentum for further gains.

Meanwhile, the directional movement index shows diverging +DI and -DI lines, highlighting the mixed sentiment in the market. DOGE’s next move will likely be influenced by how these indicators evolve in the near term.

Breakout depends on the $0.21 level

As Dogecoin continues to consolidate, its ability to push past the $0.21 resistance remains critical.

A successful breakout could pave the way for a rally of 20% or more.

Failure to break above this threshold, however, may result in prolonged sideways movement or renewed bearish pressure.

Current trading patterns and wallet activity suggest that bulls are gaining ground, but confirmation is still needed.

With price now back at $0.1540, up 10% in the last 24 hours, the market appears to be reacting positively despite recent setbacks.

The next few sessions could provide more clarity on whether DOGE is gearing up for a sustained move higher.

The post Dogecoin price up 10% to $0.1540 after 12% dip appeared first on CoinJournal.