The best crypto is a digital asset with real-world use cases, an active community, a solid team, cutting-edge technology, and a clear future roadmap. You can choose the best crypto to invest in now based on these factors.

Cryptocurrency is a digital currency that uses cryptography for secure transactions and operates on a decentralized network called blockchain. Simply, it works by allowing you to exchange value directly without the need for intermediaries.

In this guide, we will review the 10 best crypto to buy now. You will know what cryptocurrency is and how it works, and finally, we will leave you with a simple guide on how to get started with cryptocurrency.

1. Solaxy ($SOLX)

Solaxy ($SOLX) is a Layer 2 scaling solution built on the Solana blockchain, aiming to enhance transaction speed, reduce costs, and improve scalability for decentralized applications (dApps). By leveraging Solana’s high-performance infrastructure, Solaxy seeks to provide developers and users with a seamless and efficient environment, addressing common challenges such as network congestion and scalability limitations.

| Ticker | Presale Funding | Total Supply | Where to Buy? |

| SOLX | ~$26 million* | 138,046,000,000 SOLX | Official Solaxy Website |

*Market cap based on presale funds raised; subject to change upon public trading.

Pros:

- Solaxy addresses scalability issues on the Solana network, potentially improving transaction speeds and reducing congestion.

- The project offers staking opportunities with competitive annual percentage yields (APY), providing incentives for long-term holders.

- The substantial funds raised during the presale indicate robust investor interest and confidence.

Cons:

- Solaxy’s long-term success rests on its ability to deliver and gain acceptance.

2. BTC BULL Token ($BTCBULL)

BTC Bull Token ($BTCBULL) is a meme-inspired cryptocurrency designed to reward holders as Bitcoin’s price ascends. Launched in early 2025, BTCBULL offers unique incentives, including Bitcoin airdrops and token burns, triggered by Bitcoin reaching specific price milestones. For instance, when Bitcoin hits $150,000 and $200,000, BTCBULL holders receive Bitcoin airdrops. Additionally, every $25,000 increase in Bitcoin’s price prompts a burn of BTCBULL tokens, aiming to enhance scarcity and potentially boost value.

| Ticker | Presale Funding | Total Supply | Where to Buy? |

| BTCBULL | ~$50.25 million* | 21,000,000,000 BTCBULL | Official BTCBULL Website |

*Market cap based on presale funds raised; subject to change upon public trading.

Pros:

- Bitcoin Airdrops at milestones like $150K & $200K BTC price

- Regular token burns aim to reduce supply, potentially increasing token value

- Staking Rewards with dynamic APY for long-term holders

Cons:

- Market Volatility may cause significant price fluctuations

- Dependent on Bitcoin performance for value & rewards

3. Mind of Pepe ($MIND)

MIND of Pepe ($MIND) is an innovative cryptocurrency project that combines meme culture with advanced artificial intelligence (AI) to offer real-time market insights and autonomous interactions within the crypto community. The platform’s AI agent autonomously engages with influencers, platforms, and communities, providing $MIND token holders with early access to emerging trends and exclusive opportunities.

Launched in early 2025, MIND of Pepe has garnered significant attention, raising over $1 million on the first day of its presale. The project also offers a staking program with an annual percentage yield (APY) of 1204% for early participants, incentivizing long-term engagement.

| Ticker | Presale Funding | Total Supply | Where to Buy? |

| MIND | ~$1 million* | 100,000,000,000 MIND | Official Mind of Pepe Website |

*Market cap based on presale funds raised; subject to change upon public trading.

Pros:

- AI-driven market insights for real-time crypto analysis

- Engaged community with 18K Twitter followers & active Telegram

- Innovative tokenomics, with 25% supply controlled by AI

Cons:

- Not listed yet on major exchanges (still in presale)

4. Best Wallet

Best Wallet is a non-custodial cryptocurrency wallet designed to provide users with full control over their digital assets. It supports thousands of major cryptocurrencies across over 50 blockchains, including Bitcoin, Ethereum, and USDT. The wallet’s user-friendly interface allows for the seamless buying, trading, storing, and selling of cryptocurrencies directly within the app.

Additionally, Best Wallet offers a unique Token Launchpad feature, granting users early access to new token launches and presales, potentially enhancing investment opportunities.

| Ticker | Presale Funding | Total Supply | Where to Buy? |

| BEST | ~$7.5 million | 1,000,000,000 BEST | Official Best Wallet Website |

*Market cap estimated based on early listings; subject to change as liquidity and exchange listings grow.

Pros:

- Non-custodial, user-first design with full key ownership

- Broad multi-chain support and integrated trading features

- Launchpad access for early token investments

- Upcoming utility with the Best Card

Cons:

- The project is still in the early stages; limited historical performance

- Some features are not yet live (e.g., Best Card)

5. SUBBD ($SUBBD)

SUBBD ($SUBBD) is a blockchain-based meme cryptocurrency positioned to bridge AI technology with the rapidly growing subscription content market. Unlike traditional meme tokens that primarily rely on hype, SUBBD prioritizes tangible use-cases by facilitating direct interactions between content creators and their audiences. Users can leverage the native $SUBBD token to access exclusive AI-generated content, personalized experiences, and rewards through staking. The project’s roadmap includes launching advanced AI Creator tools designed to empower users in developing customized virtual influencers, enhancing community engagement.

| Ticker | Presale Funding | Total Supply | Where to Buy? |

| SUBBD | ~$4.4 million* | 1,000,000,000 SUBBD | Official SUBBD Website |

*Market cap based on presale funds raised; subject to change upon public trading.

Pros:

- Combines meme coin popularity with practical use cases involving AI-driven content creation.

- Strong early partnerships, featuring over 2,000 creators with a combined audience exceeding 250 million.

- Clear and balanced tokenomics designed to support long-term platform sustainability and user engagement.

- Offers staking opportunities with a competitive fixed annual percentage yield (APY) of 20%.

- Unique AI Creator tools planned to enable users to create personalized virtual influencers, enhancing community interaction.

Cons:

- Heavy reliance on maintaining creator partnerships and active community engagement could be challenging long-term.

- Competitive landscape in both AI-driven solutions and meme-based tokens may affect the project’s market positioning.

- Its performance significantly depends on continuous innovation and adoption within the rapidly changing content-creator market.

6. CatSlap ($SLAP)

CatSlap ($SLAP) is a meme-inspired cryptocurrency that combines entertainment with blockchain technology. Launched in November 2024, CatSlap introduces a unique “Slap-to-Earn” feature, allowing users to engage in interactive activities to earn rewards. The project aims to differentiate itself in the crowded meme coin market by offering a community-driven platform with gamified elements.

| Ticker | Market Cap | Total Supply | Where to Buy? |

| SLAP | ~$2.2 million* | 9,000,000,000 SLAP | Binance, Uniswap, Best Wallet, etc |

*Market cap based on presale funds raised; subject to change upon public trading.

Pros:

- The “Slap-to-Earn” mechanism adds a gamified layer to user interaction, potentially increasing community engagement.

- Emphasis on community participation and rewards fosters a loyal user base.

- Token burns are implemented to reduce supply over time, potentially enhancing token value.

Cons:

- High volatility typical of meme coins

- As a meme coin, CatSlap may experience significant price fluctuations influenced by market sentiment

- Limited exchange availability

7. Bitcoin (BTC)

Bitcoin is the first-ever cryptocurrency, released in 2009 by a mysterious creator, known by the name Satoshi Nakamoto. Using Bitcoin or BTC, you can send and receive money without any bank or intermediary. It works on the blockchain technology. It’s a public ledger, which is a record of every transaction. This provides a form of transparency and security.

The network involves a Proof of Work (PoW) mechanism. Although its scarcity and value are due to the capped supply of 21 million coins, Bitcoin’s mining process is quite energy-consuming. Also, it has been known for issues such as slower transaction speed and high fees during high usage periods. Despite the issues, Bitcoin is the most recognized and influential cryptocurrency.

| Ticker | Market Cap | Total Supply | Where to Buy BTC? |

| BTC | $1.8T | 19.8M BTC | Binance, Bybit, MEXC, etc. |

Pros

- Decentralized and not controlled by governments

- Enables fast and global transactions anytime

- Limited supply reduces inflation risks

- Provides high transparency with blockchain technology

Cons

- Highly volatile, prices fluctuate frequently

- Lacks widespread acceptance for daily transactions

8. Ethereum (ETH)

Ethereum is a blockchain platform launched in July 2015 by Vitalik Buterin. But, unlike Bitcoin, it is not solely a digital currency; it is a source of decentralized apps (dApps) driven by smart contracts. These contracts automatically perform transactions when conditions are satisfied, meaning that they don’t need any intermediary.

Ethereum began using Proof of Work (PoW), but in 2022, it migrated to a greener Proof of Stake (PoS) system with “The Merge” update. PoS methods involve validators who stake Ether (ETH) for securing the network, and Ether is also used to pay for transactions and other computational services. Ethereum is generally the backbone of many DeFi platforms and NFTs. But, high fees and network congestion have posed problems.

| Ticker | Market Cap | Total Supply | Where to Buy ETH? |

| ETH | $403B | 120.4M ETH | Binance, Coinbase, OKX, etc. |

Pros

- Supports smart contracts for decentralized applications

- Transitioning to energy-efficient Proof-of-Stake

- Hosts diverse DeFi and NFT ecosystems

- Interoperable standards like ERC-20 and ERC-721

Cons

- Scalability issues lead to network congestion

- High transaction fees during peak times

9. Solana (SOL)

Solana is a fast blockchain that was launched in 2020, specifically for scalability and low fees. It works on Proof of History, which timestamps transactions. Currently, it processes transactions at speeds of up to 65,000 tps. That means Solana is quite faster than most blockchains, including Ethereum.

You can use Solana for DeFi, NFTs, and gaming applications. And recently, it has been popular among memecoin traders. This is because developers and projects love its efficiency and low costs. But, the network has had some reliability issues, such as outages, that make users question its long-term sustainability. Still, Solana keeps growing and attracting innovative projects.

| Ticker | Market Cap | Total Supply | Where to Buy SOL? |

| SOL | $89.2B | 480M SOL | Binance, Bitget, Jupiter, Raydium etc. |

Pros

- Processes up to 65,000 transactions per second

- Transaction fees are less than $0.01

- Scalable architecture supports decentralized applications

- Best ecosystem for meme coin crypto traders

Cons

- Network outages raise reliability concerns

10. Avalanche (AVAX)

Avalanche is another similar platform that was launched in September 2020. It is fast and customizable. Its unique consensus mechanism combines Proof of Stake (PoS) with Avalanche consensus. This helps in confirming thousands of transactions per second.

On the working side, Avalanche has three integrated chains: X-Chain for creating and trading assets, C-Chain for smart contracts, and last, P-Chain for coordinating validators and creating subnets. And, its token AVAX is used for fees, staking, and governance on the network. Avalanche’s flexibility attracts many DeFi projects and enterprise solutions.

| Ticker | Market Cap | Total Supply | Where to Buy AVAX? |

| AVAX | $15B | 409M AVAX | Bybit, MEXC, Binance, etc. |

Pros

- Processes over 4,500 transactions per second

- Near-instant transaction finality enhances user experience

- Low transaction fees reduce user costs

- Energy-efficient consensus mechanism

Cons

- Validators must stake 2,000 AVAX tokens

- Potential centralization due to validator requirements

What is cryptocurrency?

Cryptocurrency is digital money that exists solely in the online world. It doesn’t have physical coins or bills, unlike the cash you have in your wallet. The primary concept of cryptocurrency is based on blockchain technology to ensure security and decentralization; in other words, no company, bank, or government can control it.

Cryptocurrencies operate on a system referred to as blockchain. Its specialness is that it is shared across many computers around the world, meaning that it is almost impossible to change or hack it. Also, it’s transparent, meaning anyone can view the transactions, even though he or she may not know who made them.

So, how does cryptocurrency work?

Cryptocurrencies rely on cryptography. Now, each transaction is verified by a network of computers called miners, who solve complex problems confirming the transaction. Then that transaction is added to the blockchain.

Assume that you send some Bitcoin to your friend. Now, this transaction gets recorded on the blockchain. No one can undo it or double-spend the same Bitcoin because of how the blockchain is designed.

The best use cases or applications of cryptocurrencies are:

- Online payments and transactions

- Cross-border remittances

- Investment and trading

- Smart contracts (like those on Ethereum)

- Decentralized Finance (DeFi) platforms

- Non-Fungible Tokens (NFTs)

- Supply chain management

- Gaming and virtual goods

Is crypto a good investment?

Yes, cryptocurrency can be a good investment, but it’s also quite risky. The prices can go up and down by a lot in a matter of minutes. The good part is that cryptocurrency has the potential to make huge returns in a bull market. You can earn a lot if you buy the right coin at the right time. Also, the value could go up with more and more people and businesses adopting it.

But there are risks, too. Cryptocurrencies are not regulated like stocks so there is less protection. And since prices rely on demand, news, and trends, they cannot be predicted. Another concern is that some coins may prove to be scams or are just total failures.

So, to decide if it’s a good investment, think about these: are you willing to take the risk? Can you afford to lose the money you’re investing? And do you understand how it works?

How to get started with cryptocurrency?

Step 1: Choosing a Cryptocurrency Exchange

The first step is to select a reputable cryptocurrency exchange platform. This is where you’ll buy and sell cryptocurrencies. You can research different types of exchanges, comparing factors like fees, security features, available cryptocurrencies, and user interface. The best way to buy crypto right now is by using centralized crypto exchanges like Binance, Bybit, MEXC, Bitget, and Coinbase.

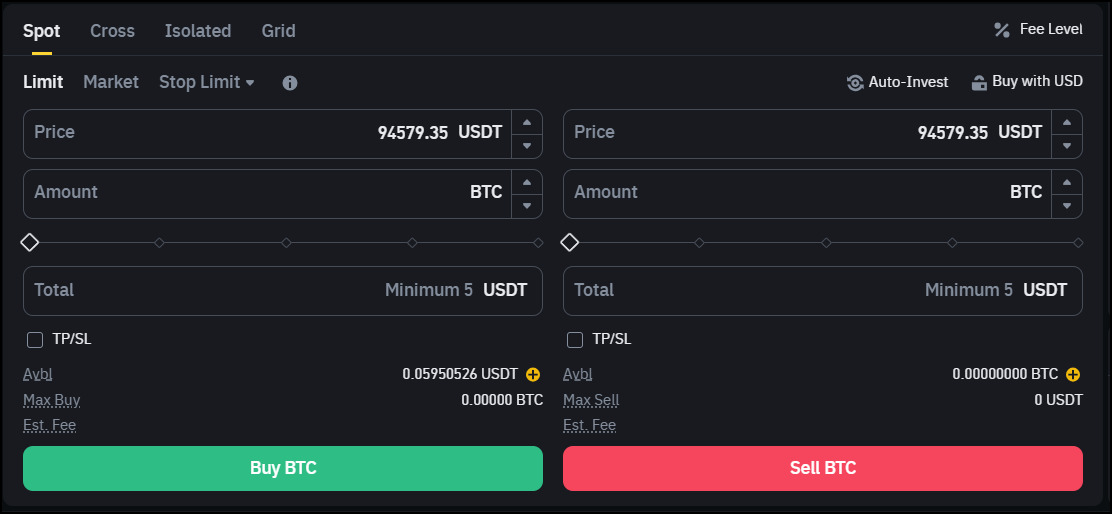

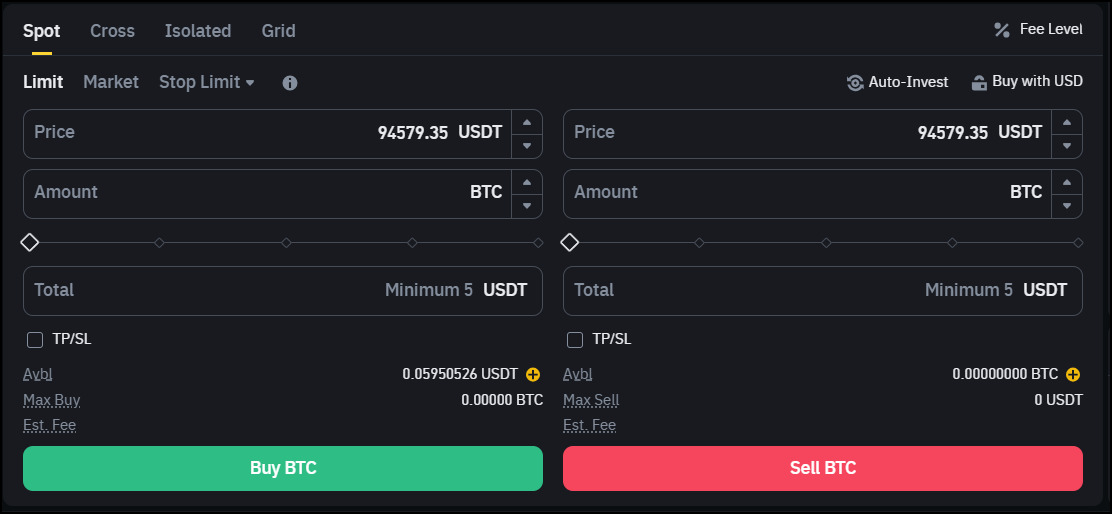

You can also check out our list of recommended best crypto exchanges. For this guide, we will learn how to use Binance to buy crypto like BTC, ETH, etc. It is one of the best crypto trading and investing platforms in the world. The exchange is built with various technical indicators to analyze the market for investors. Plus, you can use our link below to enjoy $100 in welcome rewards when you sign up.

Step 2: Create an Account and Complete KYC

Now, you need to create an account on Binance. Provide your key details like your email address, phone number, and a strong password. Also, complete the ID verification to ensure regulatory compliance. You will need to submit details like an ID proof, address, driving license or passport, and a selfie.

Step 3: Deposit Funds in Your Account

To buy cryptocurrency, you’ll need to deposit funds into your exchange account. It supports various payment methods including credit cards, debit cards, bank transfers, and 100+ local payment methods through the P2P marketplace.

Step 4: Buy Cryptocurrency or Bitcoin Now

At last, choose the specific cryptocurrency you’re interested in investing in on the exchange platform. Let’s say, you’re looking to buy Bitcoin, search for “BTC” on the exchange, and choose a trading pair like BTC/USDT. Once you’ve found the cryptocurrency, determine the amount you wish to purchase and place your order.

At last, to conclude our guide, the best crypto to buy now are Bitcoin, Ethereum, Solana, Avalanche, Binance Coin, XRP, Chainlink, Dogecoin, Toncoin, and Sui. Each of them has some unique strengths like fast transactions, smart contract support, or decentralized finance applications.

Cryptocurrency is a digital currency with the potential for high returns but also comes with some risks like high price volatility and regulatory challenges. So, always invest in crypto wisely and understand how it works. The simplest way to start investing in the crypto markets is to select an exchange, open an account, and deposit funds.