- U.S. CPI report boosts rate cut expectations.

- Traders speculate on Federal Reserve rate cuts.

- U.S. equities respond with cautious sentiment.

Interest rate futures spiked amidst growing expectations of monetary policy adjustments. This shift suggests increased confidence in rate cuts despite prior signals of a steady trajectory from the Federal Reserve. Investor strategies and sentiment appear aligned with adapting to an anticipated adjustment in policy.

Federal Reserve Chair Jerome Powell reiterated the institution’s cautious approach in response to evolving economic conditions. This statement aligns with market sentiments and positions articulated by other financial strategists.

Fed Rate Cut Speculation Surges After 2025 CPI Data

Interest rate futures spiked amidst growing expectations of monetary policy adjustments. This shift suggests increased confidence in rate cuts despite prior signals of a steady trajectory from the Federal Reserve. Investor strategies and sentiment appear aligned with adapting to an anticipated adjustment in policy.

Federal Reserve Chair Jerome Powell reiterated the institution’s cautious approach in response to evolving economic conditions. This statement aligns with market sentiments and positions articulated by other financial strategists.

“We’re prepared to respond to economic developments but will wait to see how inflation and growth evolve before making any moves.” – Jerome Powell, Chair of the Federal Reserve

Crypto Markets Brace for Impact Amid Economic Shifts

Did you know?

Traders significantly increased their rate cut expectations following the 2025 U.S. CPI release, echoing historical odds similar to those during the tariff announcements earlier in the year where a 97% probability for rate cuts was observed.

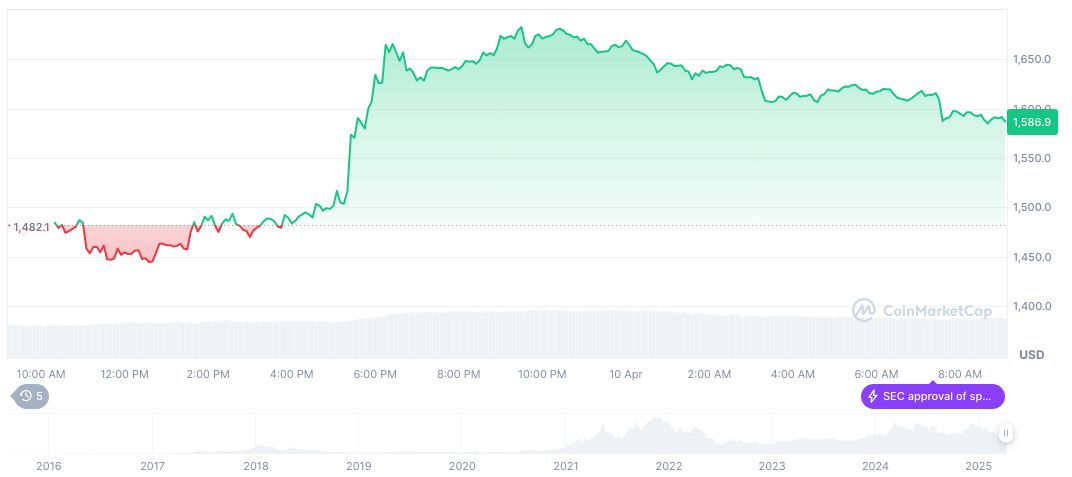

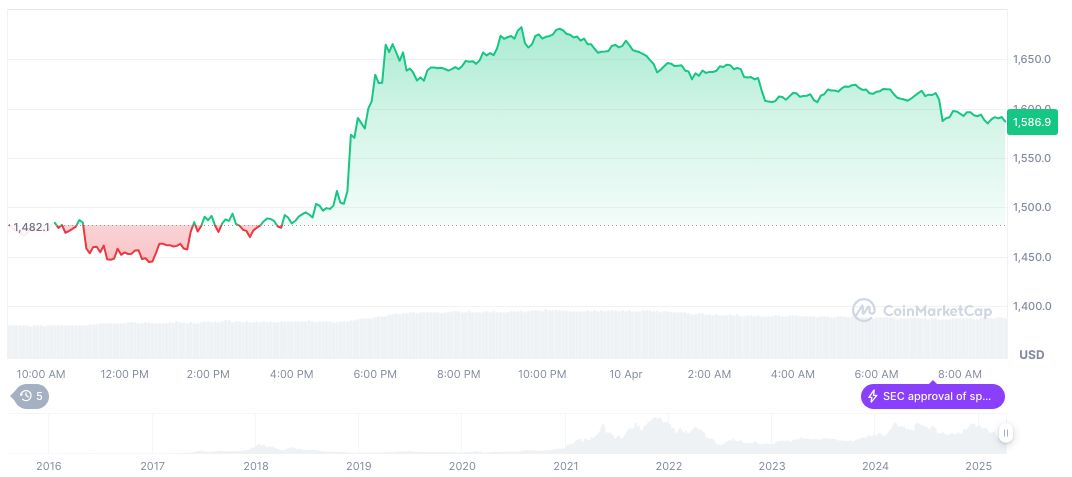

Ethereum (ETH) stands at $1,525.54, holding a market cap of $184.10 billion, as per CoinMarketCap data. Its 24-hour trading volume decreased by 48.06%, with notable price drops of 8.55% in 24 hours and 53.24% over 90 days, reflecting recent volatility. The Coincu research team indicates macroeconomic trends like CPI data will likely influence cryptocurrency valuations through increased liquidity from potential rate cuts. Regulatory and market trends continue to shape responses as industries adapt to possible adjustments in monetary policy, aligning responses with recent inflation data.

The Coincu research team indicates macroeconomic trends like CPI data will likely influence cryptocurrency valuations through increased liquidity from potential rate cuts. Regulatory and market trends continue to shape responses as industries adapt to possible adjustments in monetary policy, aligning responses with recent inflation data.

Source: https://coincu.com/331465-us-cpi-report-rate-cuts/